We are trilled to announce our brand new newsletter.

Bringing you the latest tax updates from around the world. Stay-up-to-date with the latest news.

Click here to read the full newsletter.

We are trilled to announce our brand new newsletter.

Bringing you the latest tax updates from around the world. Stay-up-to-date with the latest news.

Click here to read the full newsletter.

On 14 March 2024, The Dutch tax authorities’ knowledge group published its policy regarding the tax treatment of litigation costs under a buyer W&I insurance.

The knowledge group policy relates to a buyer W&I insurance taken out in relation to the acquisition of a subsidiary. Buyer made a claim under the insurance policy which was rejected by the insurance company. The dispute resulted in legal proceedings and buyer was ordered to pay the insurance company’s litigation costs. The knowledge group takes the position that the litigation costs should not qualify as (non-deductible) acquisition costs. Consequently, such costs are tax deductible for the Dutch taxpayer.

Tax treatment acquisition costs

Under Dutch tax law, acquisition costs are generally not tax deductible under application of the participation exemption as such costs relate to the acquisition of a subsidiary.

In 2018, the Dutch Supreme Court ruled that transaction costs are non-deductible if there is a direct causal link (in Dutch: “rechtstreeks oorzakelijk verband”) between the costs and the acquisition of a subsidiary. Hence, transaction costs are considered non-deductible to the extent that the costs are incurred as a direct result of the acquisition of a subsidiary.

In 2023, the Supreme Court provided further guidance and ruled that a direct causal link which requires that the costs must be evoked by the acquisition, includes the condition that the costs have such a causal link to the acquisition that they were incurred because they were – objectively viewed – useful or necessary to achieve that acquisition. As a further clarification, the Supreme Court indicates that the costs would not have been incurred otherwise, i.e. without that (intended) acquisition. The intended direct causal link is lacking in the case of expenses that – although – would not have been incurred if the acquisition had not taken place, but which otherwise cannot contribute in any way to the realization of that acquisition. Such expenses are not in a direct causal connection to the acquisition and the expenses are therefore not useful or necessary to bring about that acquisition.

Tax treatment W&I insurance premium

In 2022, the Dutch tax authorities’ knowledge group also published its view on the tax treatment of W&I insurance premiums and payments. Based on the authorities’ internal policy, W&I insurance premiums should not be tax deductible, while payments under the W&I insurance should be tax exempt. The premiums should qualify as transaction costs that directly relate to the acquisition of a participation. As these costs are not tax deductible, a balanced outcome would result in payments under W&I insurance being exempt under the participation exemption.

For more information, please be referred to our tax alert.

Taxand’s take

The tax authorities’ knowledge group policy provides for a welcome confirmation for buyers who have taken out a W&I insurance. We agree with the reasoning behind this policy. The publication provides for additional comfort to take the position that litigation costs incurred in relation to a W&I insurance are deductible for Dutch tax purposes. The example in the published policy relates to litigation costs in relation to an unsuccessful W&I claim, however, it should in our view also apply in relation to a successful W&I claim.

***

Please join our Taxand professionals from around the world, as we gather in Paris for Taxand’s Transfer Pricing Conference 2024. Here we will share the latest developments impacting cross-border business operations.

This dynamic event promises to provide practical insights to address ever-changing business opportunities, as well as the chance to directly interact with your transfer pricing peers.

Conference Venue: L’Apostrophe, 83 Avenue Marceau, 75008 Paris.

Our welcome reception will take place from 7pm on Wednesday 24 January at Le Fouquet’s, 97/99 avenue des Champs Elysées 75008 Paris. Coffee will be available from 8.30am and the conference begins at 9.15am on Thursday 25 January at L‘Apostrophe, closing with a networking reception from 6pm.

Our varied agenda will feature interactive sessions on a range of transfer pricing topics, including:

We look forward to welcoming client guest speakers to share the stage with our international Taxand experts.

We hope you can join us!

The Dutch House of Representatives passed a number of amendments to the 2024 Tax plan. Two of these amendments relate to the further scaling down of the 30% ruling, provided the Dutch Senate will also agree to these changes. In addition, a number of changes to the 30% ruling have already been definitively adopted.

In the attached memo, we explain the planned amendments and also set out the changes already adopted.

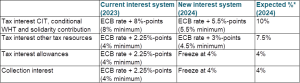

On Budget Day 2024, the State Secretaries of Finance informed the House of Representatives of the proposed changes to the interest rates on interest on underpaid tax (tax interest) and interest on overdue tax (collection interest).

On 9 December 2022, the Dutch Ministry of Finance announced certain proposed amendments to Dutch fund taxation regimes. Find here a quick overview including our Taxand takes