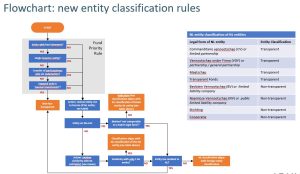

- As part of the 2025 Dutch tax plans, Dutch tax law will be amended from 1 January 2025 in a way that a Dutch ‘Commanditaire Vennootschap’ partnership will in principle classify as tax transparent. Currently, tax transparencv requires that the LPA provides for unanimous consent on any LP admission/transfer/relative-change-of-ownership.

- The new tax law includes a rule that entails potential overkill for CV’s that classify as ‘investment fund’ for Dutch securities law purposes (basically: funds with a regulated/registered/exempt manager). These CV’s may classify as non-tax-transparent from 2025 onwards, hence subject to Dutch corporate tax on their worldwide income, and withholding tax on distributions. Two exceptions apply:

-

- The CV is an active PE fund. No guidance is given to the definition of ‘active PE fund’. Controlling majority stakes are important indicators. It is yet unclear if the exception equally applies to venture capital funds.

- Amendment of the LPA in a way that LP interests can – basically – only be transferred via the Fund, i.e. through redemption and subsequent issuance.

- On the second exception: in reply to criticism by the Dutch fund industry on the timing constraints of amending LPA before 2025, the government has announced that such amendment may also be done in 2025, provided that the fund manager expresses its intention to amend still in 2024.

- The overkill rule above is considered an unfortunate development. Whilst the rule was initially meant to apply to foreign (i.e. non-Dutch) real estate funds only, the rule unfortunately also applies to certain Dutch funds.

- Last week, in reply to criticism by the Dutch fund industry, the Dutch government has agreed to review this overkill rule in the first half of 2025. Whilst the outcome of this review is uncertain, the government may conclude to amend the overkill rule. More news is expected in the second half of 2025 – probably in September as part of the Tax Plans 2026.