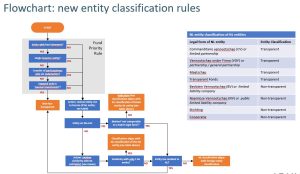

As per 2025, new rules will apply to the classification of Dutch and foreign entities as transparent or non-transparent.

Dutch (CV) and foreign limited partnership entities will classify as tax transparent by default. Hence, in principle no ‘unanimous consent’ required anymore on LP admissions/transfers (current requirement).

However, the government introduces an exception to certain Dutch and foreign fund entities engaged in ‘passive’ investments. These will classify as non-transparent and become subject to Dutch taxes. A carve-out applies to fund entities engaged in ‘active’ investments, or implementing a ‘redemption-only’ liquidity mechanism. Implementation may take place in 2025, subject to conditions.

See flowchart on the next slide for more details.